Understanding business finance, lesson 2

11 June 2014 by Catherine Holdsworth in Business and finance

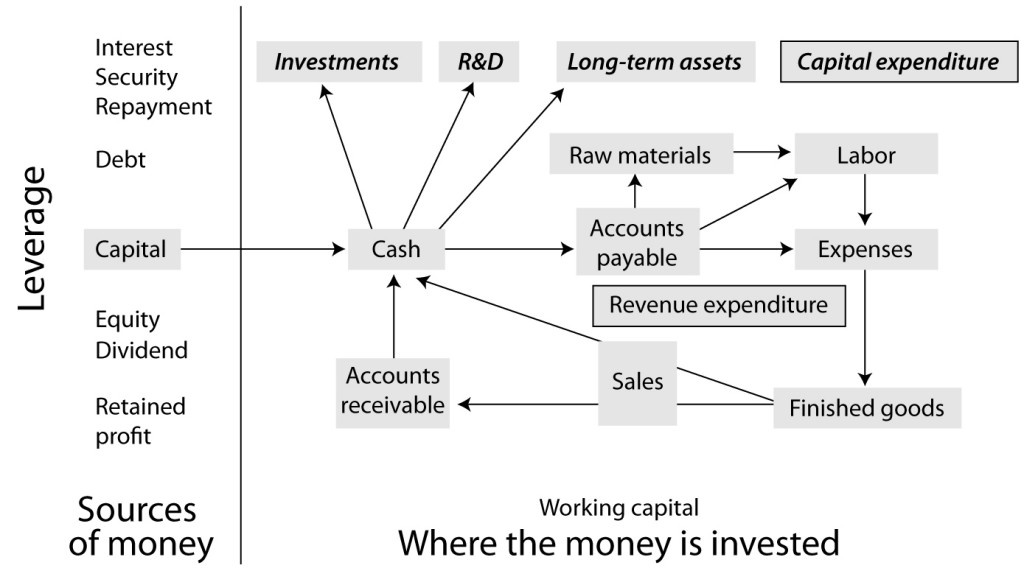

Last week we looked at sources of finance. This week we’re taking a look at how the money is used.

Where the money is invested

The equity and debt come into the company as cash. Managers spend this on, for example, raw materials, labor and expenses in the case of a manufacturer, or mainly on labor in a service business. We will use the manufacturing business as our example since it is easier to visualise the process round the business model.

The combined inputs of material, labor and expenses produce an inventory of finished goods. These are sold to customers for either cash or credit. In the business model diagram, you will also see accounts payable. These occur when materials or services the company acquires from outside suppliers are supplied on credit. So the cycle is complete from the supply of the goods needed to produce the product to successful sales.

You can see that the managers of the business must have sufficient capital to get round the cycle at least once, then the income earned from the first sale can finance the second sale and so on. The term used to describe the amount needed to keep the cycle running is working capital.

There are two objectives in the working capital cycle:

- The managers want to get round the working capital cycle and arrive back at the beginning with more money than they started with. They want to make a profit.

- The managers want to get round the working capital cycle as quickly as possible. In this way they will minimize the amount they need to borrow to finance working capital.

Some industries excel in speeding cash round their working capital cycle. Major grocery stores, for instance, will often take less than twenty days from when they receive goods until the proceeds from the sales are in their checking account. If they can agree a payment period to suppliers of thirty days, you’ll find that their suppliers fund all their working capital needs. And that, because of their immense power over suppliers, is just what they do.

It’s not so easy when you are selling complex products that take a lot of time to manufacture and which can then sit on the shelves waiting for a customer. In this sort of business, the production department should ideally incorporate raw materials and parts into the product on the day they are delivered by the supplier (known as ‘just-in-time’). In this ideal world a customer will be waiting to buy each product as it comes off the assembly line and into inventory. And, finally, in this commercial Utopia customers will pay their bills on the day that was agreed in the contract. This Utopia is difficult to achieve but represents the objectives of the managers of the business.

In the next blog we’ll look at revenue and capital expenditure.